Loans

No matter what type of borrower you are, from a first home buyer to a seasoned investor, illis has a loan that is perfect for you.

We appreciate that whilst competitive interest rates are an important factor in choosing your Home Loan, you may also require other features. That’s where illis has an edge. Providing you with wide range of banks/ financial institutions with various loan products, rates and features.

Home Loans

At the outset, the home loan schemes of all the banks / financial institutions look the same.

However, differences in the features are plenty. Rate of Interest, Processing fee, flexibility in the quantum of loan to be financed, Part-Payment and Pre-Closure Options, conditions of Co-Applicant or even the service standards ensures that every offering from a bank/financial institution is unique.

Our team member, will take you thru each offering in detail, enabling you to choose the option that best suits you loan requirement.

Products covered under Home Loan category:

- Purchase [Flat / Row House / Bungalow from developer, existing free hold properties etc].

- Construction of a residential dwelling unit on a plot already owned.

- Purchase of a residential plot and/or construction thereon.

- Extension of existing residential property [adding floors / rooms]

- Renovation of existing residential property

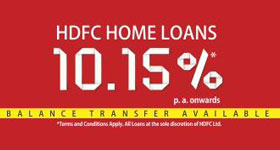

- Balance Transfer of existing Home Loan from another bank/ financial institution.

Home Loan for NRI’S

If you are a Non-Resident Indian and dream of owning a home back in India, Home Loan for NRI’s is available. This enables you to buy or build a property, extend or renovate a property or even buy a plot to build a house.

Who is an NRI?

A person resident outside India , who is a citizen of India or a person outside Indian who is of Indian Origin is an NRI.

The definition of Person resident outside India is defined under section 2(w) of Foreign Exchange Management Act, 1999.

Products covered:

- Purchase Loan

- Mortgage Loan

- Commercial Property Loan

- Loan Against Rentals.

Mortgage Loans

We understand how difficult it is to choose between your aspirations to become successful entrepreneurs & your personal priorities.

A sudden financial need can arise at any time, meet it with a loan against your property. This finance solution lets you unlock the full potential of your property. The loan against property can be availed to meet your personal expenses, your child’s higher education, your child’s marriage expenses, and above all your business expansion.

This loan can be as high as 65% of the market value of your property and is available to both Resident Indians & NRI’s.

Property Type: Residential & Commercial

Commercial Property Loans

Build something BIGGER!

When business expansion opportunities or the possibilities of a new business idea arise, you can have the power to take advantage of them with a commercial property Loan.

With maximum funding and payment flexibility, a lack of finance need will never be an issue.

Loan Against Rentals

Make the most of your commercial property given out on rent. Take a loan against its rental value. Having a self owned commercial property given out on rent enables you to get the liquidity against the expected future rentals of the property.

Purpose of this loan can be any productive purpose like Completing existing projects or taking up new projects.

Business, Trade / Commercial activities.

Repayment of existing loans etc,.